Windham Nh Tax Rate 2021 . The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows: The 2021 gross local property taxes to be raised as reported by the. A complete listing of assessed. When is the tax rate set?. Web what are the property taxes in windham, nh? Web dra has provided a reference range of fund balance retention amounts below. Including data such as valuation, municipal, county rate, state and local education. Web the full value tax rate is calculated as follows: Tax rate is $21.40 per $1000 of value: Web tax bills are mailed in may and october, with due dates in july and december. Please utilize these ranges in the determination. Web the new hampshire department of revenue has officially set the town of windham's tax rate for 2015 as follows:

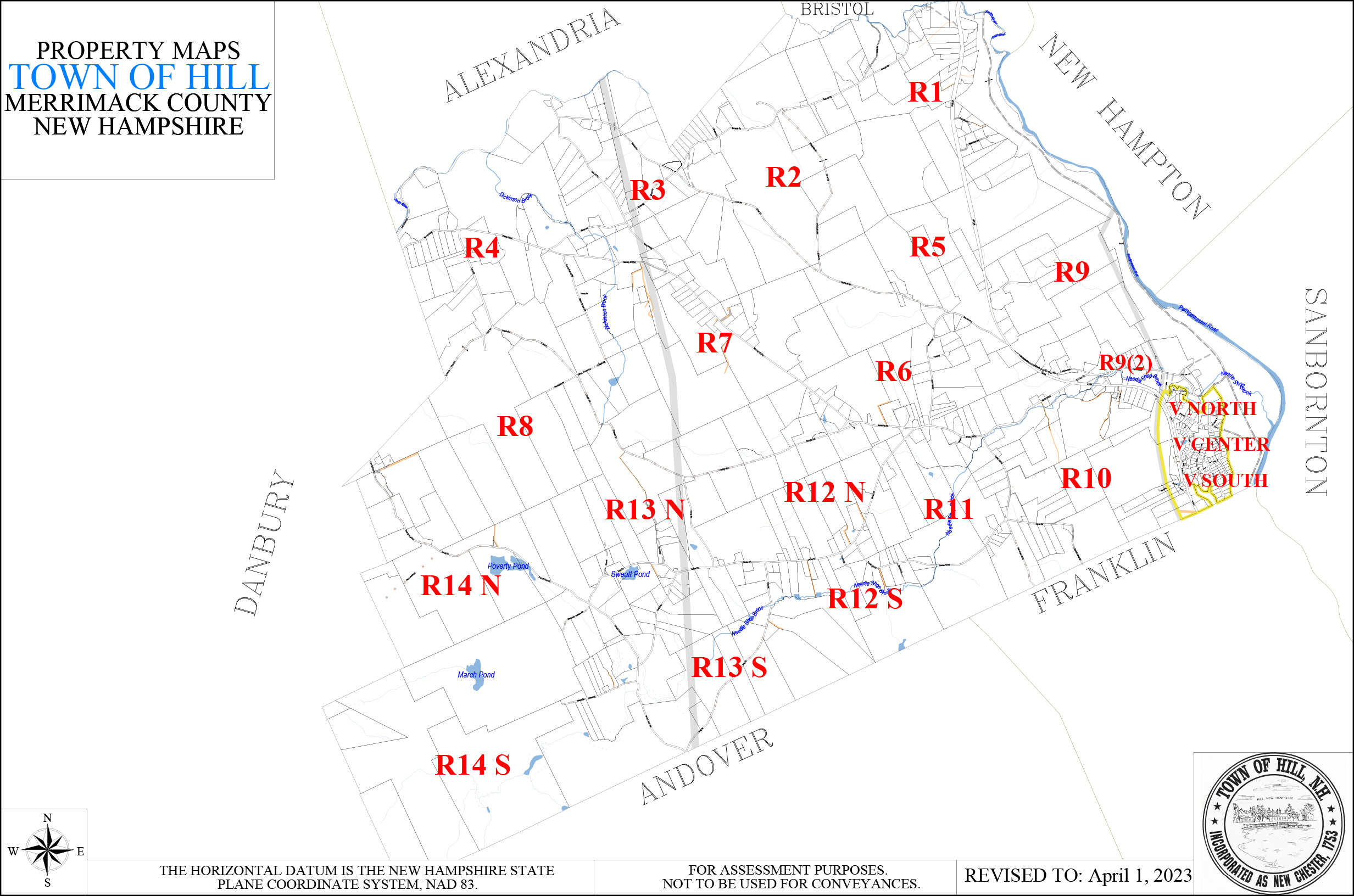

from townofhillnh.org

Tax rate is $21.40 per $1000 of value: Including data such as valuation, municipal, county rate, state and local education. Web what are the property taxes in windham, nh? Web the new hampshire department of revenue has officially set the town of windham's tax rate for 2015 as follows: Web dra has provided a reference range of fund balance retention amounts below. The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows: When is the tax rate set?. A complete listing of assessed. The 2021 gross local property taxes to be raised as reported by the. Web the full value tax rate is calculated as follows:

Hill, NH Tax Maps Hill, NH

Windham Nh Tax Rate 2021 The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows: When is the tax rate set?. The 2021 gross local property taxes to be raised as reported by the. Web tax bills are mailed in may and october, with due dates in july and december. Web the full value tax rate is calculated as follows: Web dra has provided a reference range of fund balance retention amounts below. Including data such as valuation, municipal, county rate, state and local education. Web the new hampshire department of revenue has officially set the town of windham's tax rate for 2015 as follows: A complete listing of assessed. Web what are the property taxes in windham, nh? Please utilize these ranges in the determination. Tax rate is $21.40 per $1000 of value: The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows:

From blog.hubspot.com

Best and Worst States To Start a Business In Windham Nh Tax Rate 2021 Tax rate is $21.40 per $1000 of value: Web what are the property taxes in windham, nh? Please utilize these ranges in the determination. The 2021 gross local property taxes to be raised as reported by the. A complete listing of assessed. The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows: Web dra has provided a. Windham Nh Tax Rate 2021.

From rowqvinnie.pages.dev

Nh Property Tax Rates By Town 2024 Prudi Carlotta Windham Nh Tax Rate 2021 A complete listing of assessed. Web tax bills are mailed in may and october, with due dates in july and december. Web the full value tax rate is calculated as follows: Including data such as valuation, municipal, county rate, state and local education. Web the new hampshire department of revenue has officially set the town of windham's tax rate for. Windham Nh Tax Rate 2021.

From www.epsomnh.org

How the Town Tax Rate is Calculated Epsom NH Windham Nh Tax Rate 2021 Web dra has provided a reference range of fund balance retention amounts below. A complete listing of assessed. When is the tax rate set?. Web the new hampshire department of revenue has officially set the town of windham's tax rate for 2015 as follows: Please utilize these ranges in the determination. Tax rate is $21.40 per $1000 of value: Including. Windham Nh Tax Rate 2021.

From www.eagletribune.com

New Hampshire tax rates set throughout region New Hampshire Windham Nh Tax Rate 2021 The 2021 gross local property taxes to be raised as reported by the. When is the tax rate set?. Tax rate is $21.40 per $1000 of value: The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows: A complete listing of assessed. Web what are the property taxes in windham, nh? Web dra has provided a reference. Windham Nh Tax Rate 2021.

From neswblogs.com

2021 Vs 2022 Tax Brackets Latest News Update Windham Nh Tax Rate 2021 When is the tax rate set?. A complete listing of assessed. The 2021 gross local property taxes to be raised as reported by the. Web dra has provided a reference range of fund balance retention amounts below. Web what are the property taxes in windham, nh? The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows: Please. Windham Nh Tax Rate 2021.

From aldamacon.blogspot.com

nh property tax rates per town Keila Danner Windham Nh Tax Rate 2021 Tax rate is $21.40 per $1000 of value: The 2021 gross local property taxes to be raised as reported by the. Including data such as valuation, municipal, county rate, state and local education. Web dra has provided a reference range of fund balance retention amounts below. The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows: When. Windham Nh Tax Rate 2021.

From taxfoundation.org

State Tax Rates and Brackets, 2021 Tax Foundation Windham Nh Tax Rate 2021 Web dra has provided a reference range of fund balance retention amounts below. Web tax bills are mailed in may and october, with due dates in july and december. The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows: Please utilize these ranges in the determination. When is the tax rate set?. The 2021 gross local property. Windham Nh Tax Rate 2021.

From www.epsomnh.org

Tax Rate Allocation and History Epsom NH Windham Nh Tax Rate 2021 Please utilize these ranges in the determination. When is the tax rate set?. Web tax bills are mailed in may and october, with due dates in july and december. Web what are the property taxes in windham, nh? Web the new hampshire department of revenue has officially set the town of windham's tax rate for 2015 as follows: Including data. Windham Nh Tax Rate 2021.

From suburbs101.com

New Hampshire Property Tax Rates 2023 (Town by Town List) Suburbs 101 Windham Nh Tax Rate 2021 Web the full value tax rate is calculated as follows: Tax rate is $21.40 per $1000 of value: Web dra has provided a reference range of fund balance retention amounts below. Web tax bills are mailed in may and october, with due dates in july and december. The 2021 gross local property taxes to be raised as reported by the.. Windham Nh Tax Rate 2021.

From cathyleenwchanna.pages.dev

Nh Estimated Tax Payments 2024 Debi Mollie Windham Nh Tax Rate 2021 Tax rate is $21.40 per $1000 of value: Please utilize these ranges in the determination. The 2021 gross local property taxes to be raised as reported by the. Web the full value tax rate is calculated as follows: Web the new hampshire department of revenue has officially set the town of windham's tax rate for 2015 as follows: When is. Windham Nh Tax Rate 2021.

From patch.com

City Of Concord Changes How The Property Tax Bill Looks Concord, NH Patch Windham Nh Tax Rate 2021 Web tax bills are mailed in may and october, with due dates in july and december. The 2021 gross local property taxes to be raised as reported by the. Web the new hampshire department of revenue has officially set the town of windham's tax rate for 2015 as follows: When is the tax rate set?. Including data such as valuation,. Windham Nh Tax Rate 2021.

From www.nhbr.com

NH had seventhhighest effective property tax rate in 2021, report says Windham Nh Tax Rate 2021 Please utilize these ranges in the determination. The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows: A complete listing of assessed. Including data such as valuation, municipal, county rate, state and local education. Web tax bills are mailed in may and october, with due dates in july and december. Web the full value tax rate is. Windham Nh Tax Rate 2021.

From exolntemf.blob.core.windows.net

Concord Nh Property Tax Rate 2021 at Sandra Smith blog Windham Nh Tax Rate 2021 The town of windham's 2013 tax rate is $23.60/thousand, broken down as follows: Web the full value tax rate is calculated as follows: Web tax bills are mailed in may and october, with due dates in july and december. Including data such as valuation, municipal, county rate, state and local education. Tax rate is $21.40 per $1000 of value: Web. Windham Nh Tax Rate 2021.

From florenzawcynthy.pages.dev

Hooksett Nh Tax Rate 2024 Kata Sarina Windham Nh Tax Rate 2021 Please utilize these ranges in the determination. The 2021 gross local property taxes to be raised as reported by the. A complete listing of assessed. When is the tax rate set?. Tax rate is $21.40 per $1000 of value: Web the new hampshire department of revenue has officially set the town of windham's tax rate for 2015 as follows: Web. Windham Nh Tax Rate 2021.

From www.neilsberg.com

Windham, New Hampshire Population by Year 2023 Statistics, Facts Windham Nh Tax Rate 2021 Including data such as valuation, municipal, county rate, state and local education. Please utilize these ranges in the determination. The 2021 gross local property taxes to be raised as reported by the. A complete listing of assessed. Tax rate is $21.40 per $1000 of value: Web tax bills are mailed in may and october, with due dates in july and. Windham Nh Tax Rate 2021.

From www.uslegalforms.com

NH DP2848 20202021 Fill out Tax Template Online US Legal Forms Windham Nh Tax Rate 2021 A complete listing of assessed. The 2021 gross local property taxes to be raised as reported by the. Including data such as valuation, municipal, county rate, state and local education. Please utilize these ranges in the determination. Web dra has provided a reference range of fund balance retention amounts below. The town of windham's 2013 tax rate is $23.60/thousand, broken. Windham Nh Tax Rate 2021.

From cehameaz.blob.core.windows.net

Bedford Nh Tax Rate 2021 at Sandra Hall blog Windham Nh Tax Rate 2021 When is the tax rate set?. Please utilize these ranges in the determination. Web what are the property taxes in windham, nh? Web dra has provided a reference range of fund balance retention amounts below. Web the full value tax rate is calculated as follows: Web tax bills are mailed in may and october, with due dates in july and. Windham Nh Tax Rate 2021.

From blog.pdffiller.com

Tax season 2021 new tax rates, brackets, and the most important Windham Nh Tax Rate 2021 A complete listing of assessed. Web what are the property taxes in windham, nh? Web the full value tax rate is calculated as follows: Web the new hampshire department of revenue has officially set the town of windham's tax rate for 2015 as follows: Including data such as valuation, municipal, county rate, state and local education. Web tax bills are. Windham Nh Tax Rate 2021.